Q1 Letter - 2024

Q1’2024 Recap: Another Strong Start

The US equity markets remained strong through Q1, supported by earnings expectations rising slightly as earnings have exceeded Wall Street’s expectations. About half of the S&P 500 companies have reported earnings as of 4/29/24, and ~77% of companies have beat expectations, which is more than 3% higher than the average over the last 10 years. The magnitude of beats has also been impressive. In aggregate, companies are reporting earnings that are 8.4% above estimates, which is essentially in-line with the 5-year average of 8.5%, but above the 10-year average of 6.7%. On a year-over-year basis, this will be the 3rd straight quarter of S&P 500 earnings growth. The earnings growth rate for the first quarter is expected to be 3.5%.

This momentum and resiliency in US corporate earnings has surprised many as evidenced by many investors being positioned overly cautious (record high levels of cash and near-cash, low equity allocations relative to history, low margin levels relative to exuberant times, etc.), but it has been a mistake to underestimate the ability of US-based companies to preserve their earnings even in a softer demand environment in certain sectors.

Even more important is what is expected to happen through the rest of the year. Looking ahead, analysts expect (year-over-year) earnings growth rates of 9.7%, 8.6%, and 17.3% for Q2, Q3, and Q4, 2024, respectively. For CY 2024, analysts are calling for (year-over-year) earnings growth of 10.8%.

What Could Go Wrong?

Well, a lot, of course. Responsible portfolio risk management requires a constant awareness of potential big shocks, a general reduction in portfolio risk as probabilities of external threats increase, and a more active eye on what events and data are moving markets to understand what is already priced in (expected) in asset prices. A trend we’re watching closely is that personal spending rose by 0.80%, outpacing personal income increases of 0.50% in March. Also, the personal savings rate fell to 3.20%, down 0.4% from February and from 5.2% last year. With wage growth slowing and inflation staying somewhat sticky, concerns about consumers’ ability to spend at an increasing rate through the end of the year have more merit than they did at the beginning of the year.

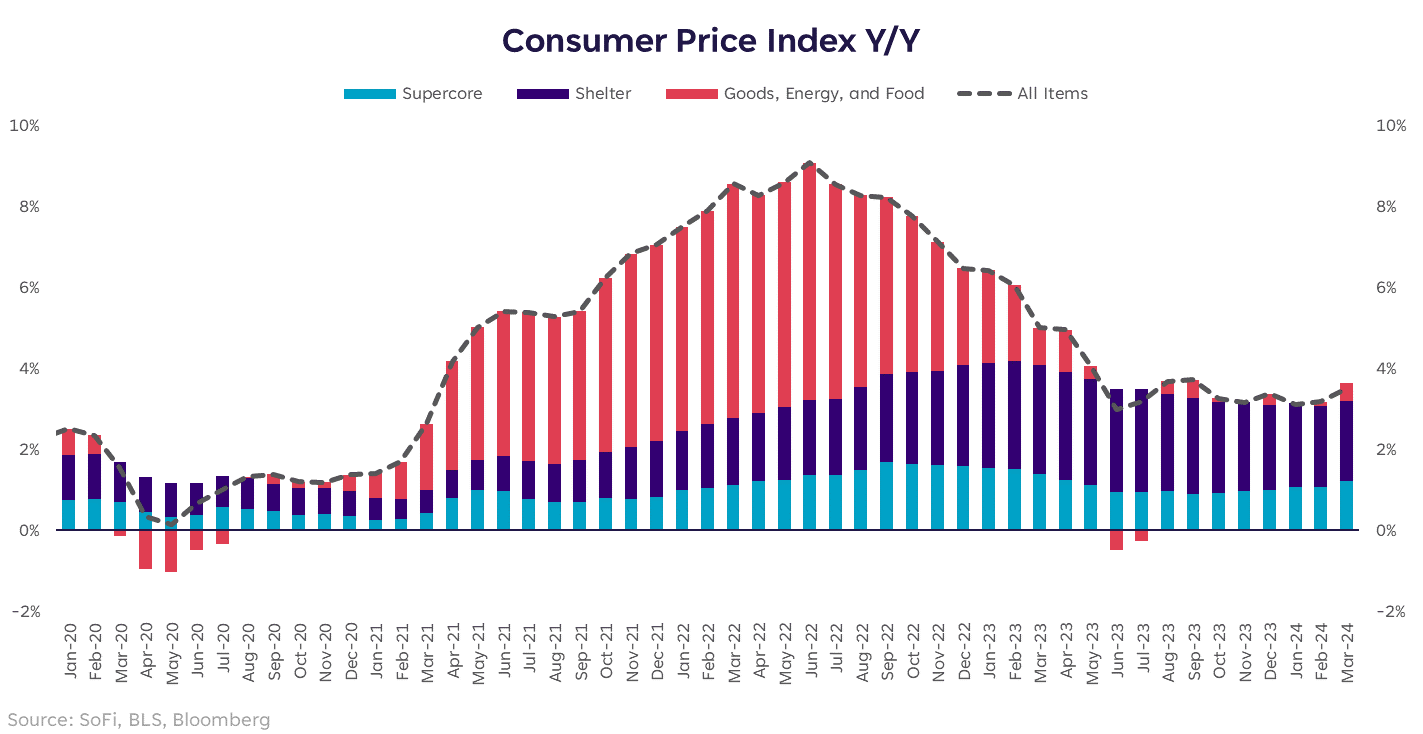

This strain on consumers and their savings rate can also be seen in the consumer sentiment surveys, which took a hit in April, as forward inflation expectations rose to their highest level since November 2023. The fact that inflation occurred in such a compressed period plays a significant role in the sour sentiment. To put it into perspective, while the Consumer Price Index (CPI) rose by approximately 20% throughout the entirety of the 2010s, it also climbed by the same percentage from 2020 to 2023 alone. People are sick of price increases, so corporations are likely to have a challenging time pushing them through at the same rate. This is already being seen in many parts of the economy, evidenced by the median Core CPI (ex. food and energy) having only risen 1.76% YoY, well-below the long-term average of 2.4%. The higher inflation of Core CPI we have seen the first three months of the year is attributable to shelter inflation persisting (although that is statistically lagging), stemming from a combination of a lack of supply homeowners unwillingness to give up their “golden handcuff” mortgages that were locked in when rates were lower. Shelter is responsible for more than half of the inflation we’re still experiencing (see chart below).

Additionally, the surge in auto insurance premiums has further contributed to this inflationary pressure which picked up from the last three months of 2023.

Rate Cuts Continue to be Pushed Out

As inflation data comes in hotter than expected, the consensus timeline for future rate cuts continues to get pushed out. When looking to history for insights regarding the typical rate cycle, we often find that hiking cycles unfold gradually and methodically, while cutting cycles tend to be swift and dramatic, usually to control damage. The Fed hiked interest rates a total of 11 times between March 2022 and July 2023, but it has been 9 months now with no rate cuts. If there are no rate cuts by November 2024, that would be the longest time that the Federal Reserve has held peak policy rates at the top of a tightening cycle. Given that the US consumer and household wealth has never been as strong entering the later stages of the cycle before, it would make sense for us to be capable of handling these higher rates for longer, and that seems to be getting priced in by markets. Only two cuts are now priced in for 2024, while at the beginning of the year, it was six. While a strategy of cutting rates because it's desired may seem ideal for the economy and markets, there's a good chance events may not unfold in such a smooth manner, but that doesn’t mean that the companies we are largely allocated to won’t be able to navigate those circumstances and continue to preserve or even grow their earnings.

Looking Ahead… Cautiously Optimistic

Analogous to sports, we have to be in the “ready position” to take action in case events and data show signs of the labor market cracking. US consumers will continue to spend as long as they are employed. As noted in our previous letter, the bottom line has been that as long as the labor market remains robust, consumer spending, which accounts for ~70% of our economy, is likely to remain healthy. In March 2024, payrolls jumped by 303,000, well above the estimate of 200,000. If inflation remains sticky and stubborn around ~3% or even inflects up again slightly, that’s likely not high enough for the Fed to disregard the other half of their dual mandate: the unemployment rate. In an environment where inflation remains above the Fed’s target of 2%, but not out of control and too high to the point where further hikes are warranted, it’s risky NOT to own assets such as stocks when the value of cash is decreasing.

Additionally, asset prices are likely to be relatively supported even in a cooling demand environment given the Fed is in a position of strength and can lower interest rates from their current restrictive levels of 5.25% - 5.5%, which likely limits the downside risk and can prevent the US economy from a painful recession which is still fresh in many people’s memories. This recency bias has kept many investors overly cautious. It’s incorrect to assume that other future recessions will be equally as damaging as the most recent recession, which is freshest in our minds. Remember, US corporate earnings already did have a 3-quarter recession that ended Q2’2023. It’s possible that’s as painful as it gets for US corporate earnings. As you can see in the chart below, the large technology companies are experiencing very real tailwinds boosted by technological advancements that will ultimately benefit other corporations as well, which has translated to increased earnings for the technology companies in the near-term, and will likely proliferate through other companies over time.

In conclusion, the resilience and adaptability demonstrated by US corporations amid a multitude of recent challenges, from the seismic shifts in how we work and live caused by COVID-19 to volatile shifts in oil prices and supply chain disruptions from geopolitical events, have underscored their ability to manage risks and thrive in dynamic environments. Our battle-tested portfolio of companies are more resilient and able to manage risks than ever before thanks largely to technology and diversification of revenue streams. Now, these companies are reaping the rewards of their adaptability, as they embrace a combination of cost optimization tactics and heightened productivity driven by advancements in artificial intelligence (AI). Looking ahead five years from now, as we approach the latter part of the 2020s, it's plausible to envision that the sustained progression of these technological innovations will stand as a central pillar of optimism for the remainder of the decade, and what they can do for corporate earnings. It's hard to imagine betting against the ingenuity and adaptability of US corporations as they have clear levers to pull to enhance their efficiency and economic value that they create. We are grateful for the trust that you have placed in us to monitor these conditions affecting the financial markets, and we look forward to continuing to serve as your partner in achieving your financial goals. If you have any questions or concerns, please do not hesitate to contact us.

Information presented reflects the personal opinions, viewpoints and analyses of the employees of Mirador Capital Partners, LP, an SEC-registered Investment Adviser. The views reflected in the commentary are subject to change at any time without notice. Nothing herein constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mirador Capital Partners, LP manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Visit us at miradorcp.com for more information.